- 23/05/2024

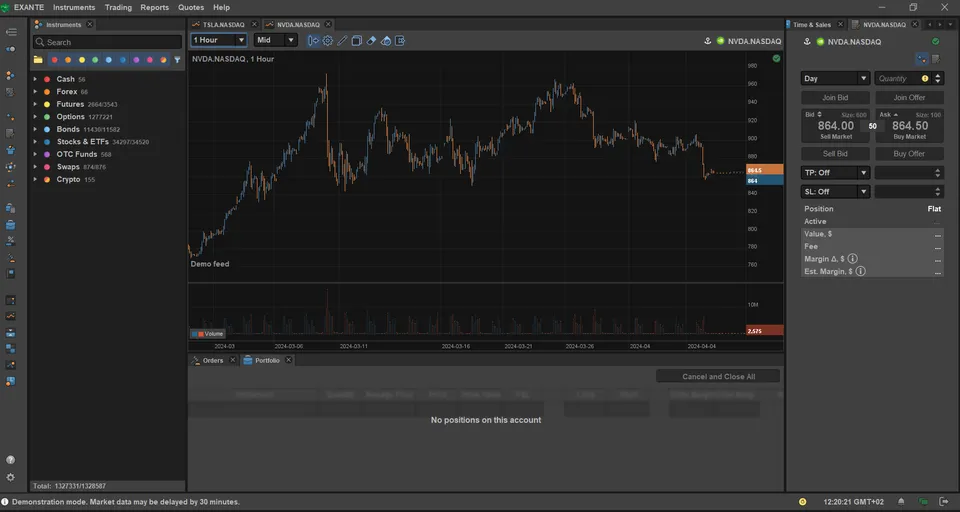

The image above is for illustration purposes only and may not be an exact representation of the product.

Established in 2011, EXANTE is a registered trademark and global trading platform that provides its clients access to global markets and over a million financial instruments. The platform caters to seasoned traders and is available to clients in over 100 countries.

This EXANTE review looks at SEC regulations and how EXANTE protects its investors. We also look at the trading platform its features, and fees.

What is EXANTE?

Owned by XNT Ltd, EXANTE is a brand name used by several regulated investment firms in the UK, Malta, Cyprus, and Hong Kong. The EXANTE trading platform serves clients such as banks, private investors, and wealth managers, and offers direct access to over 50 markets.

The trading instruments available on the EXANTE trading platform include stocks, ETFs, bonds, options, futures, funds, and metals. EXANTE has won multiple awards, including the Diversity Marketing & Recruitment Initiative of the Year award from The Financial Times, as well as Best Sustainable Investment Company 2024 - Europe at the Ethical Finance Awards.

About the SEC

The U.S. Securities and Exchange Commission (SEC) is a government agency that is responsible for protecting investors and regulating the securities markets. The SEC has five divisions: Trading and Markets, Corporate Finance, Economic and Risk Analysis, Enforcement, and Investment Management.

It was established by the Securities and Exchange Act of 1934 and the U.S. Securities Act of 1933 and can work with the Justice Department in taking civil action against lawbreakers. The SEC plays an important role in financial markets and has a triple mandate of investor protection, orderly markets, and facilitating capital formation.

Although EXANTE does not accept US clients, the investment companies operating under the EXANTE brand respect the guidelines and regulations of the SEC and as such, will comply with any official request for information and adhere to the guidelines.

Regulatory compliance

The investment companies operating under the EXANTE trademark are licensed to operate by the SFC in Hong Kong, the FCA in the UK, CySEC in Cyprus, and the MFSA in Malta, respectively.

EXANTE operates within strict ethical and financial standards and prioritizes the safety of investor funds. The broker platform is GDPR compliant, protecting against the misuse of personal information and adhering to stringent data protection laws.

EXANTE trading platform

With the EXANTE trading platform, traders have access to over a million financial instruments from a single, multi-currency account. The trading platform is available to users via the web, as a desktop platform, or as a mobile app for Android and iOS users.

It offers over one million financial instruments and access to over 50 global markets. Trading instruments include stocks and ETFs, bonds, futures, and options.

EXANTE’s web trading platform offers a convenient way of trading from your web browser without downloading any software. It has a user-friendly interface and traders can seamlessly switch between instruments, manage their portfolios, and execute trades.

The mobile application offers many similar features to the desktop application and is ideal for traders on the go. Traders have access to real-time data and trades can be executed in a few clicks. Some of the features of the mobile app include a quote monitor and portfolio summary.

The desktop version is a powerful trading platform with advanced features for experienced traders. Unlike the web version, the desktop platform operates independently from your browser and HTTP protocol, which means faster trading speeds and no unnecessary delays or connectivity issues.

The trading platform has a minimum opening deposit of 10,000 EUR/GBP for individual accounts, and 50,000 EUR/GBP for corporate accounts.

Trading fees

One benefit of trading on EXANTE is that it has a very transparent commission structure with no hidden fees. There are also no management fees and they only charge fees for actual trades.

Looking at fees for stocks and ETFs, on main U.S. exchanges the fees are 0.02 USD per share, and on European exchanges, the fees range from 0.02% to 0.18%. On Asian exchanges, the fees range from 0.1% to 0.1927%.

For futures and options, fees vary by exchange; fees for US exchanges start at 1.5 USD and fees for European exchanges start at 1.5 EUR. For currency pairs, a conversion fee of 0.25% applies to all major currency pairs and a fee of 0.4% applies to all other pairs.

Some other fees on the EXANTE trading platform include:

- Shorting stocks: 12% of the transaction as an annual rate

- Custody fee: 0.3% annually (applies to bonds)

- Margin trading fees: None as long as the margin utilization is below 100%

- Manual execution: 90 EUR for voice trading (phone/email orders)

Please note that these fees are up to date as of 2023 and the latest fees can be found on their website here.

Conclusion

EXANTE is a global trading platform that offers a wide range of trading instruments with transparent rates and commissions. Although there is a high minimum deposit requirement, it is an excellent choice for investors who are looking for a customizable trading platform with advanced features.

DISCLAIMER:

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. While every effort has been made to verify the accuracy of this information, EXT LTD. cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXT LTD. Any action taken upon the information contained in this publication is strictly at your own risk. EXT LTD. will not be liable for any loss or damage in connection with this publication. Costs mentioned herein may increase or decrease as a result of currency and exchange rate fluctuations and are subject to change.

![What [the heck] is InsurTech? image](https://media.fintastico.com/images/network-782707_1280.2e16d0ba.fill-72x72.png)