Darktrace

Machine learning company for cyber security

Overview Darktrace ?

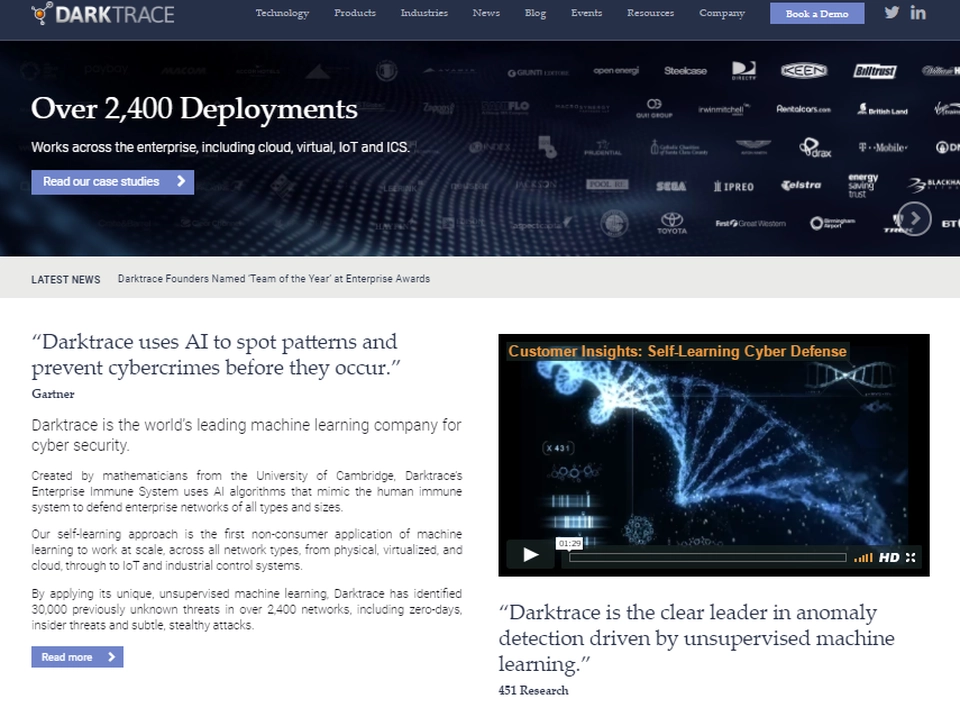

Darktrace is the world’s leading machine learning company for cyber security, having developed AI algorithms that mimic the human immune system to defend enterprise networks of all types and sizes

Latest news Darktrace

-

Cyberattacks tend to increase during holidays, experts warn

While companies tend to amp up warnings to consumers about fraud and scams during the holidays, institutions may also need to bulk up their defenses.

7 months ago

-

The Most Powerful Women in Finance: No. 21, Christina Minnis, Goldman Sachs

At Goldman, Minnis oversees teams worldwide that advise corporate and sponsor clients on their credit, acquisition and other financial decisions.

9 months, 1 week ago

-

Balderton secures $1.3B in new funds to back Europe’s top entrepreneurs

Balderton Capital, one of Europe’s leading technology venture capital firms, today announced its $615 million Early Stage Fund IX and $685 million Growth Fund II, …

10 months, 2 weeks ago