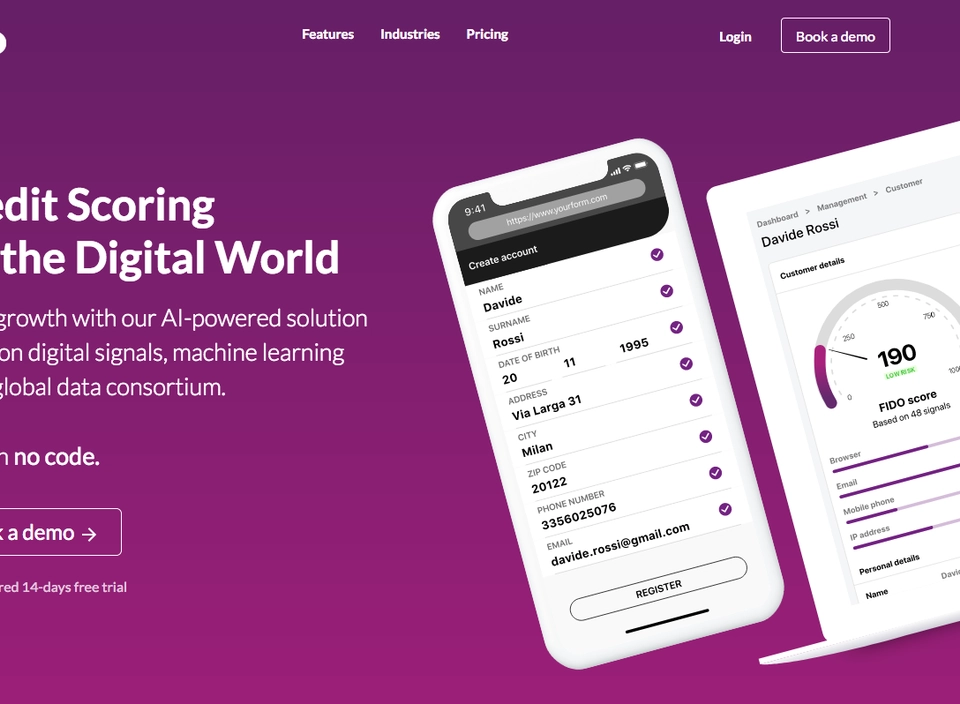

Fido

Trust your customers

Overview Fido ?

Fido analyzes the information content of the digital footprint – information that people leave online simply by accessing or registering on a network of websites – for predicting consumer default. Fido examines hundreds of digital footprints in a few seconds. Fido is used for customers for whom no credit bureau score is available, i.e., customers whose credit history is insufficient to calculate and it’s normally used to validate lower value transactions (<€ 1.000)