Opendoor

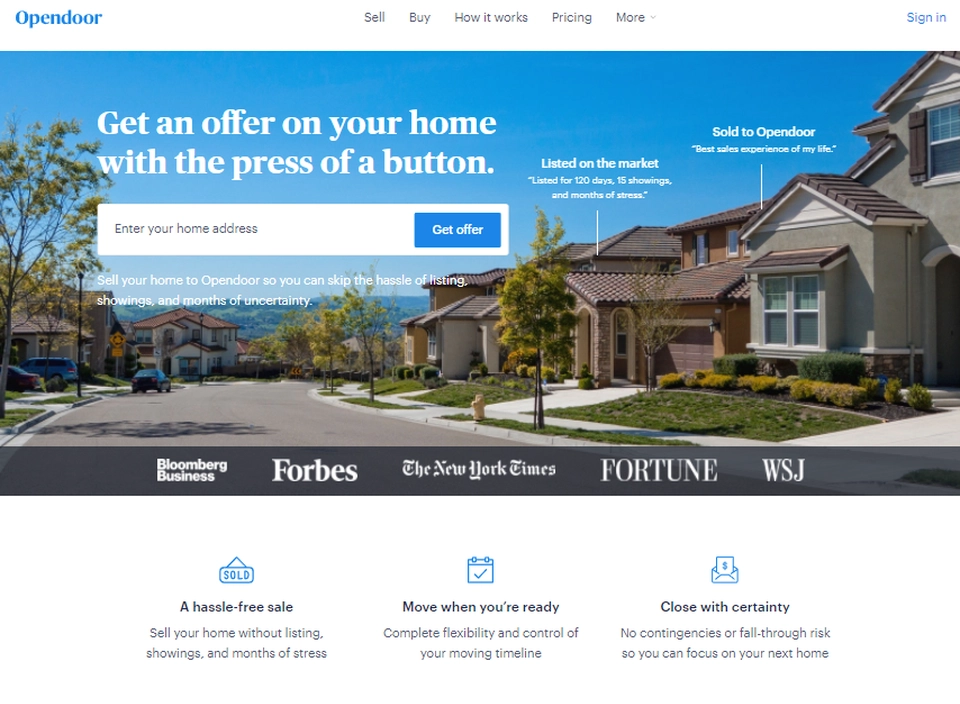

Opendoor is an online home-selling service aimed at streamlining the sales process down to a few days

Overview Opendoor ?

Whether you're accepting a new job, finding space for a growing family, or looking for something smaller, selling your home shouldn't be painful and time consuming. They are here to help