Trilo

Own your payments

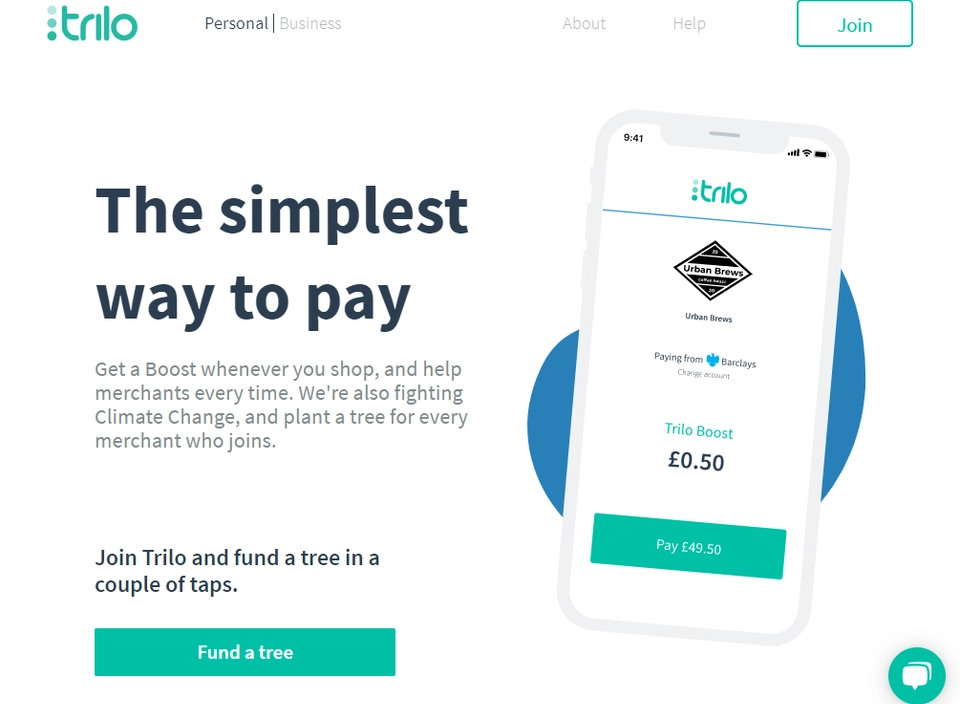

Overview Trilo ?

Trilo uses Open Banking to power our payments, running on the faster payments network. This allows us to provide highly secure, fast, and low cost payment capabilities that are entirely digital. Take payments from you customers, no cards involved, receive your funds in minutes and we only charge 0.1% per transaction. No hidden fees, and the money goes straight from your customer to you, we never touch the funds.