Playter

Funding the community of startups and scaleups by helping them convert any invoice into Buy Now, Pay Later.

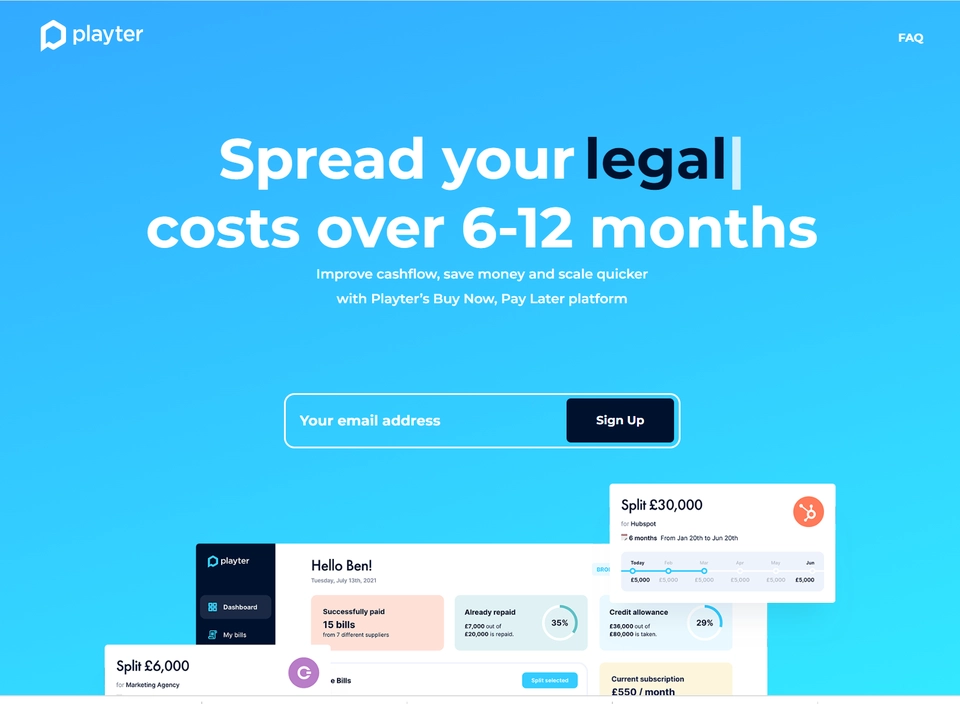

Overview Playter ?

Playter brings BNPL to the B2B space enabling businesses to pay for professional services invoices. For SMEs, the company’s platform allows businesses to take control of payment terms. This means that they can spread the cost of software, agency fees, rent, marketing, and many more payments over 6 or 12 months. SMEs can apply in five minutes and access funds in as little as 24 hours from gaining access to the platform.