Paytm

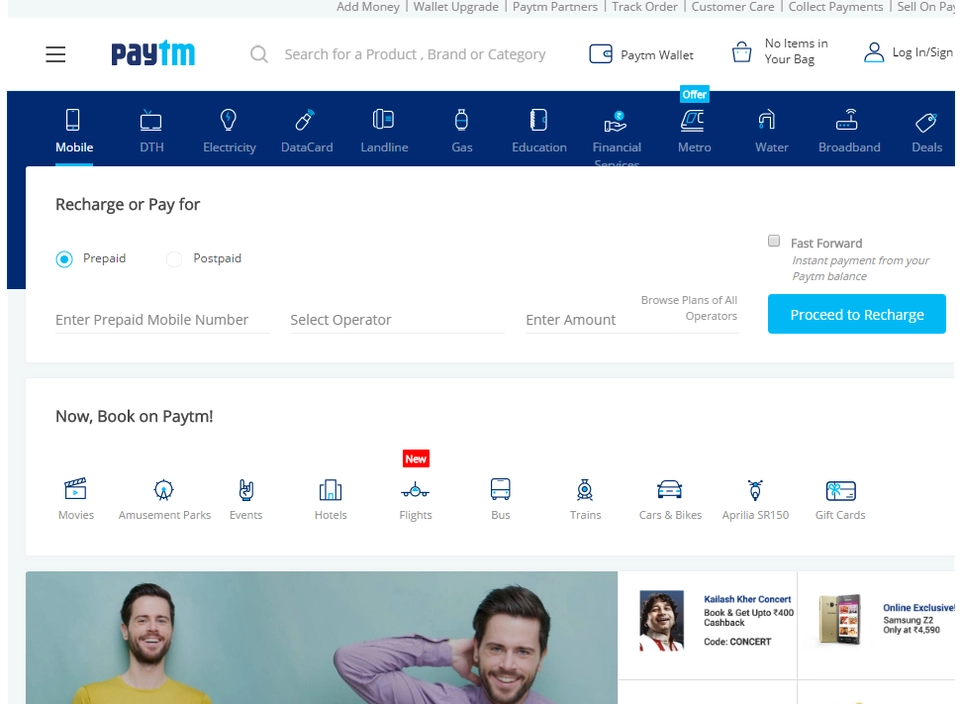

Recharge on the go for your mobile, DTH, data cards, utility bills, bus tickets and now also mobile shopping.

Overview Paytm ?

Paytm is India’s largest mobile commerce platform. Paytm started by offering mobile recharge and utility bill payments and today it offers a full marketplace to consumers on its mobile apps. We have over 20mn registered users. In a short span of time Paytm has scaled to more than 15 Million orders per month.

Latest news Paytm

-

India’s Rise in Fintech: How Digital Payment Infrastructure is Shaping Economic Growth

With a population of over 1.4 billion, India – the world’s most populous country – has immense potential to set benchmarks in fintech as part …

8 months, 2 weeks ago

-

India’s Paytm wins approval to resume payments growth

Paytm, a leading Indian financial services firm, has received regulatory approval to resume adding new UPI payments users, following an eight-month Paytm has received regulatory …

8 months, 3 weeks ago

-

India’s Paytm wins approval to resume onboarding new UPI users

Paytm, a leading Indian financial services firm, has received regulatory approval to resume onboarding new UPI users, following an eight-month restriction Paytm has received regulatory …

8 months, 3 weeks ago