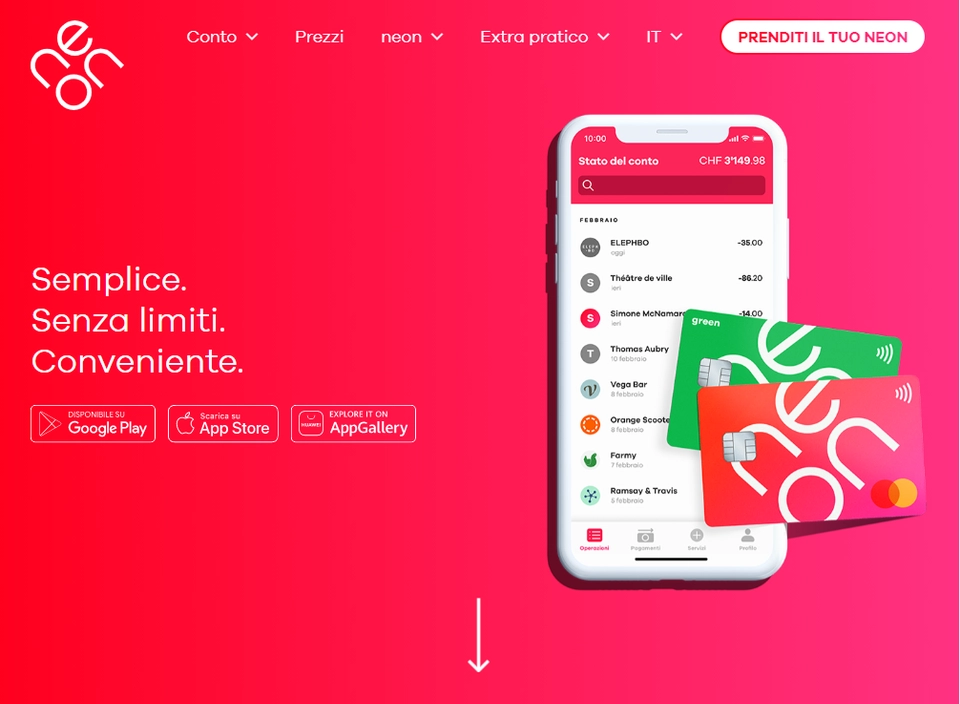

Neon

First independent account app in Switzerland. No base fees.

Overview Neon ?

neon offers a simple, user-friendly and secure account solution as an app for all smartphones. Neon also offers a sustainable account for everyday banking, backed by certified CO2 compensation from myclimate and a pledge to plant five trees per user, per month. The account also offers sustainable investments via neon partner Yove and an up-and-coming carbon-consuption tracking feature that feeds back information on the emissions generated by a user’s personal transactions.