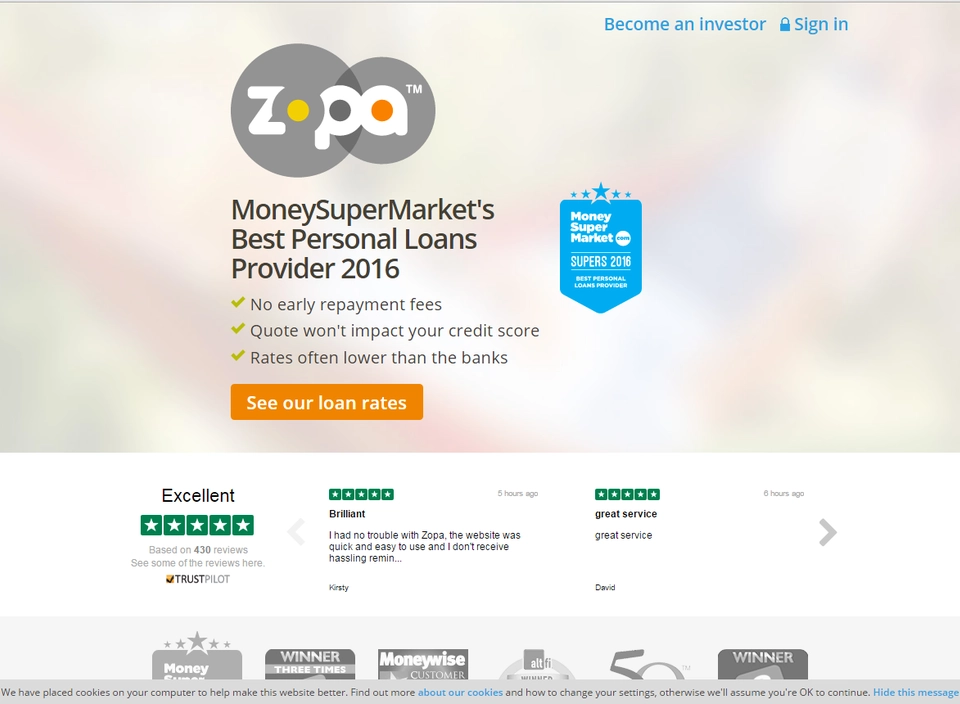

Zopa

Zopa offers peer-to-peer loans with low rates, flexible terms, and no early repayment fees.

Overview Zopa ?

Zopa is a P2P money lending service that allows lenders and borrowers to deal directly with one another, cutting out the banks who act as middlemen. Zopa works in the following way: the company first categorizes borrower credit grades with an A*, A, B, C or Y rating; then lenders make offers that vary by money amount and time period for persons with a certain credit grade; and borrowers can then agree the aggregate offered rate.

Latest news Zopa

-

Could Auto-Saving Help as 28% of Brits Fall Into Arrears on BNPL Purchases for Christmas?

With many consumers set to struggle to make repayments on BNPL purchases over the Christmas period, Zopa Bank offers an automated solution.

7 months, 2 weeks ago

-

Zopa Bank Brings Digital Personal Loan Product to 23 Million John Lewis Money Customers

Zopa Bank is partnering with John Lewis Money, to offer personal loans to its 23 million customers via the John Lewis Money website.

8 months, 3 weeks ago

-

This Week in Fintech: TFT Bi-Weekly News Roundup 17/09

The Fintech Times Bi-Weekly News Roundup takes a look at the latest fintech stories from around the world on Tuesday 17 September 2024. Partnerships Aramco …

9 months, 3 weeks ago