Upstart

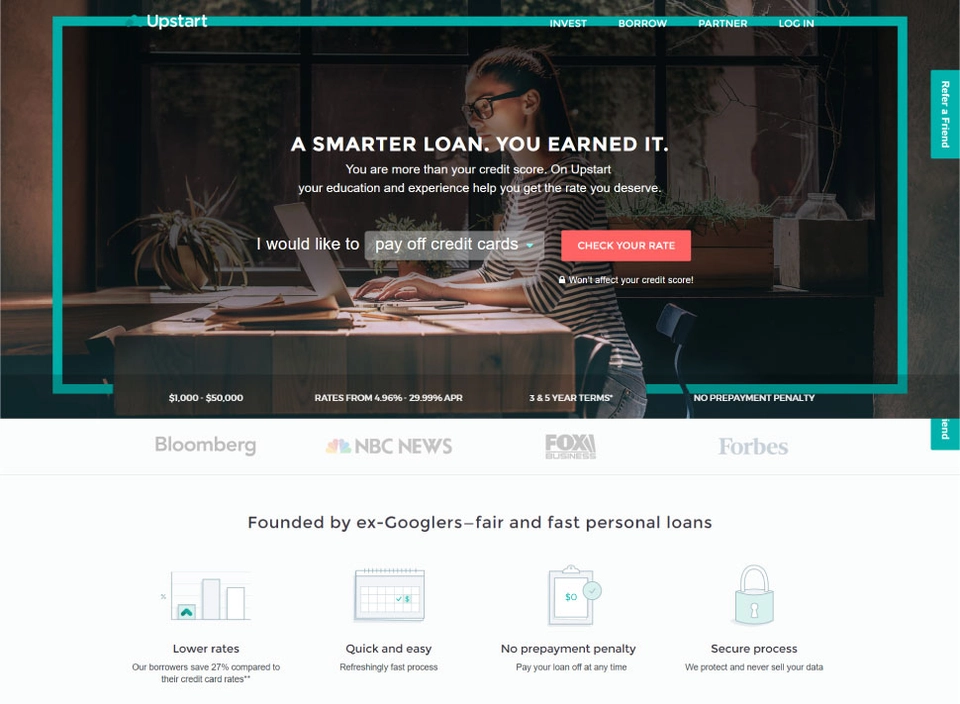

Your education and experience help you get the rate you deserve

Overview Upstart ?

Upstart goes beyond the FICO score to offer personal loans. The company's proprietary underwriting model identifies high-quality borrowers despite limited credit and employment history by using variables including schools attended, area of study, academic performance, and work experience. Upstart offers 3-year and 5-year fixed interest loans, and are primarily used to pay off credit cards, consolidate debt, eliminate student debt, start a business, or pay for a personal development bootcamp.

Latest news Upstart

-

FinTech IPO Comes Up Flat as Industry Processes New CFPB Rule 1033

For FinTechs in general, and the FinTech IPO Index in particular, this past week has been dominated by regulators, new rules related to data and …

8 months, 1 week ago

-

Upstart pivots to prime lending for partners like Alliant Credit Union

The credit union has been using Upstart's AI-based loan decision model to help creditworthy consumers consolidate their credit card debt.

8 months, 1 week ago

-

FinTech IPO Gains 3.7% as Upstart and Paymentus Lead Platforms Higher

Earnings season is barely a week old. While the headlines have centered on big banks, Wall Street trading and credit card spending, the deluge of …

8 months, 2 weeks ago