Ratesetter

P2P Investing and Borrowing

Overview Ratesetter ?

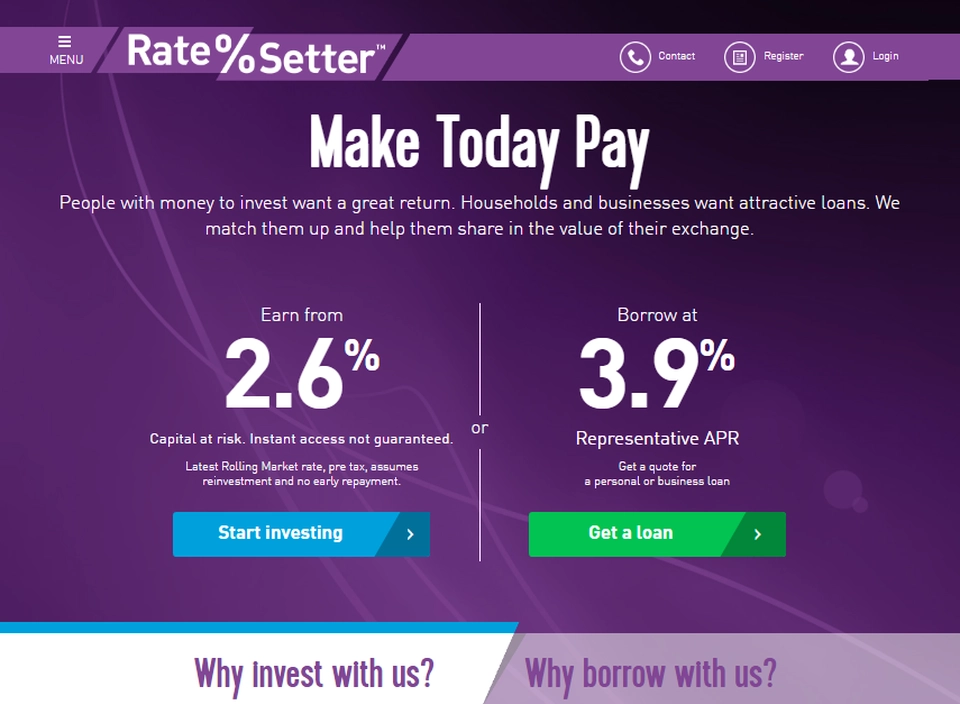

RateSetter is a peer-to-peer lending website that allows its users to lend and borrow money directly from each other according to their own interest rates. It cuts the cost of borrowing and enables those who are already in debt to get out of their debts quicker, while at the same time increasing returns for savers. The website allows savers to invest a minimum amount of £100 and borrowers get loans of up to £20,000