Funding Xchange

Bringing transparency & efficiency to business funding

Overview Funding Xchange ?

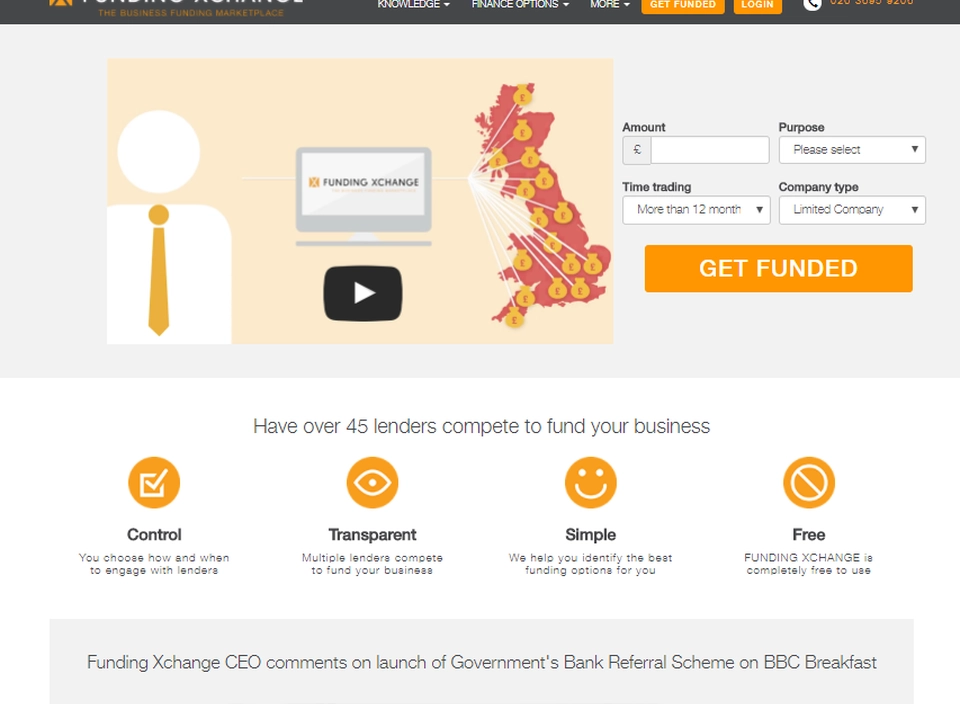

We founded Funding Xchange to help business owners navigate the funding space and take control of funding their business – addressing one of the biggest obstacles growing businesses are facing. As owners of small businesses, we have first-hand experience of how difficult it can be to find the right funding for your business – even if there are now hundreds of innovative solutions available. This led us to set up Funding Xchange, the marketplace for business funding