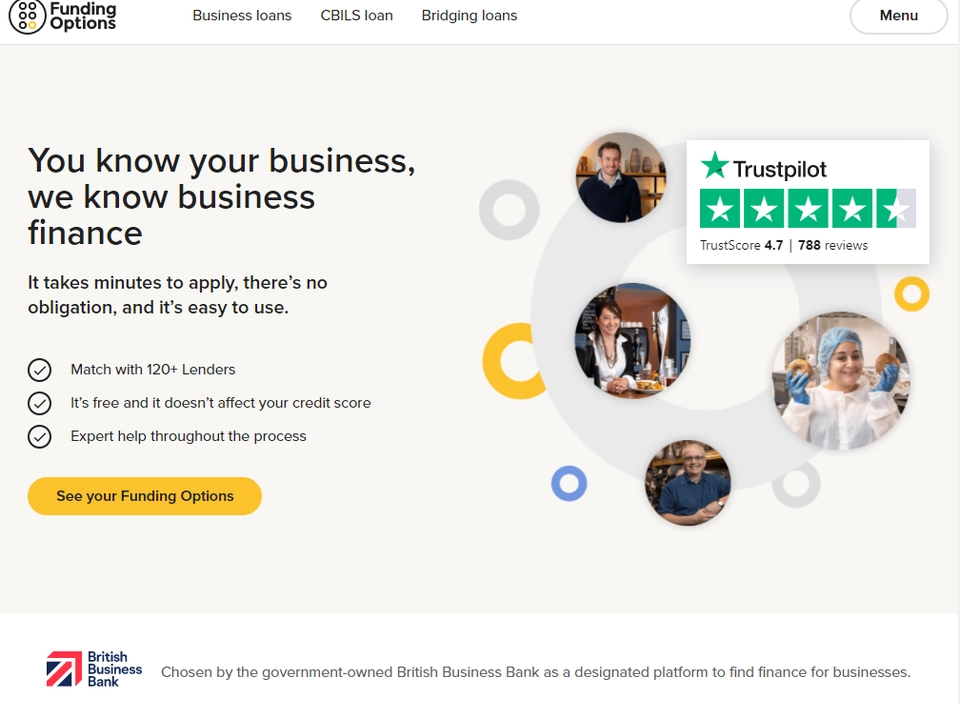

Funding Options

Funding Options uses modern web technology to help SMEs to find the right finance

Overview Funding Options ?

Based in the UK, Funding Options uses modern web technology to make it easier for small firms to access the right finance. Previously selected by judges from SWIFT as one of the world’s most promising financial technology (FinTech) firms, in 2015 Funding Options is a finalist in both Computing Magazine's UK IT Industry Awards and the IFS Financial Innovation Awards