ETHLend

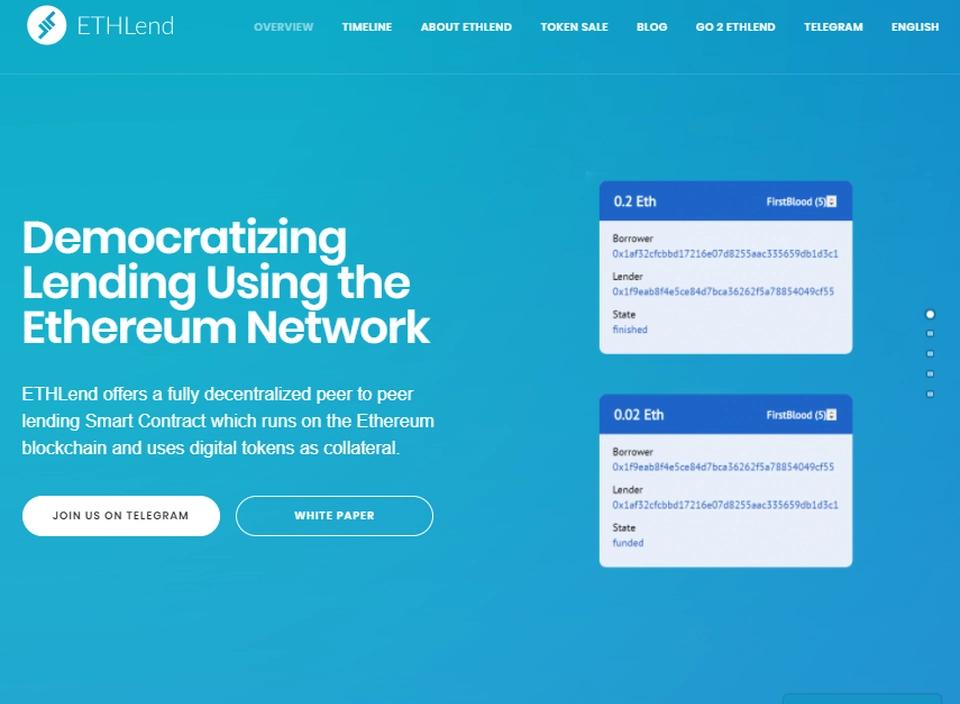

Fully decentralized peer to peer lending marketplace Decentralized and secure financial marketplace

Overview ETHLend ?

ETHLend is a fully decentralized financial marketplace built on top of the Ethereum Network allowing lenders and borrowers from all over the world to create peer to peer lending agreements in a secure and transparent way using Blockchain and Smart Contracts. Lending crypto-to-crypto removes the need for banks. By placing a loan request on ETHLend, lenders from all over the globe can fund loan requests by competing to provide the most competitive interest rate.