Earnest

Earnest rewards financially responsible people with better rates than traditional lenders

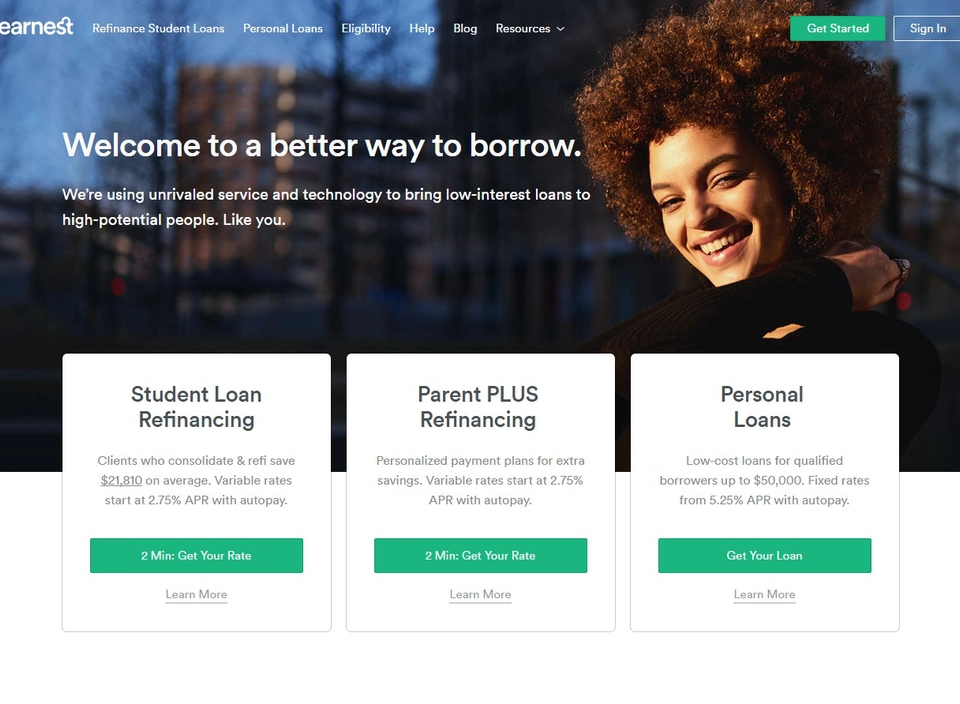

Overview Earnest ?

Earnest is a technology-enabled lending company that uses data science, design, and software automation to rebuild financial services and solutions. It enables customers to renegotiate their loan repayment amounts and interest rates for existing loans. The company evaluates financially-responsible people’s full education, employment, and financial profiles, and based on their credit scores rewards them with better rates on personal loans and student loan refinancing.

Latest news Earnest

-

Riding a strong regional economy a Georgia bank plans more branches

First National Community Bank CEO Ryan Earnest said his institution would likely use its entry into Paulding County, an Atlanta suburb, as a template for …

10 months, 3 weeks ago

-

Riding a strong regional economy, a Georgia bank plans more branches

First National Community Bank CEO Ryan Earnest said his institution would likely use its entry into Paulding County, an Atlanta suburb, as a template for …

10 months, 3 weeks ago