ClearScore

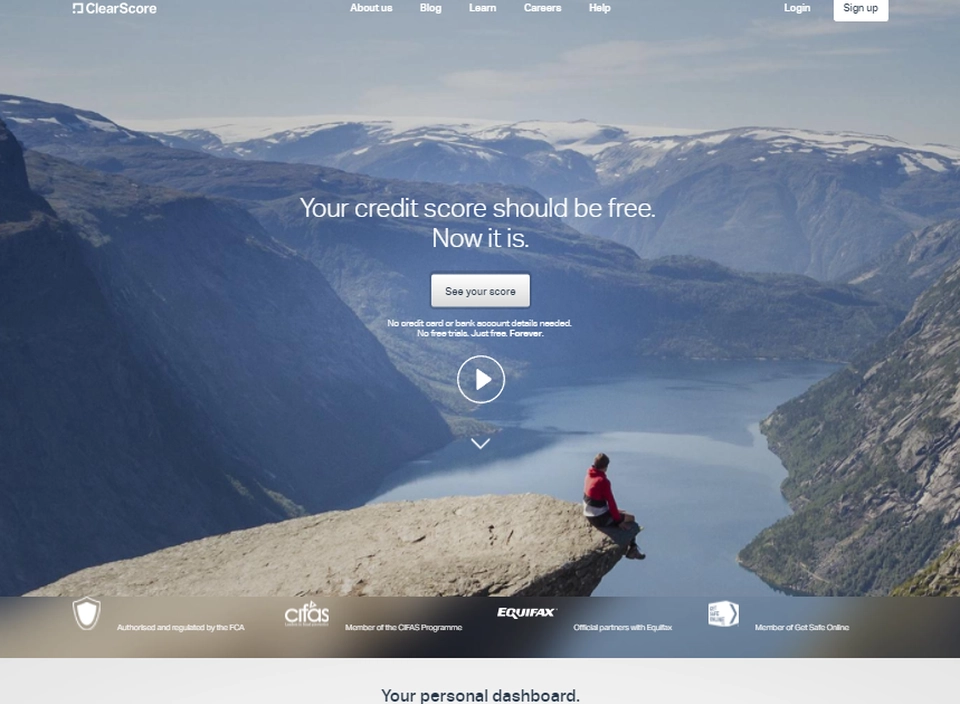

Get your credit score, report and dark web monitoring for free, forever.

Overview ClearScore ?

ClearScore’s aim is to change the way everyone manages their finances, starting with a free credit score and report. By providing a free credit score and report, ClearScore is empowering people to take control of their money and improve their financial wellbeing. ClearScore provides a personalized dashboard with a clear view of up to six years of financial details, as well as educational resources on various financial products.

Latest news ClearScore

-

This Week in Fintech: TFT Bi-Weekly News Roundup 24/09

The Fintech Times Bi-Weekly News Roundup takes a look at the latest fintech stories from around the world on Tuesday 24 September 2024. Appointments Axyon …

9 months, 1 week ago

-

The Fintech Power 50 Calls for Nominations for Innovative Fintechs

Nominations are now open for The Fintech Power 50 2025, the annual guide showcasing the most influential and innovative companies in fintech.

9 months, 2 weeks ago

-

Shortcomings in School Curriculum has Left Financial Education ‘Void’ in the UK, Says ClearScore

Almost three-quarters (73 per cent) of UK adults did not receive any education on money during their time at school, despite just shy of the …

10 months, 1 week ago