Capchase

The most flexible, non-dilutive funding for your business.

Overview Capchase ?

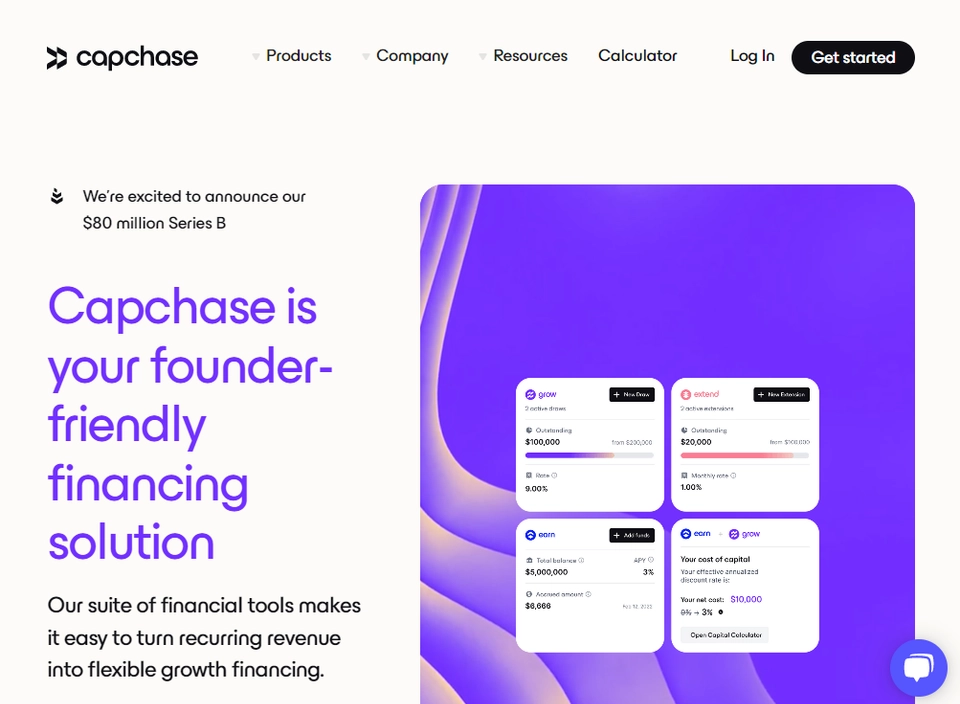

Capchase is a platform for recurring-revenue companies to secure non-dilutive capital. Founded in Boston, MA in 2020, the company provides financing by bringing future expected cash flows to the present day – thereby extending an immediate line of credit. Companies that work with Capchase are able to secure funding that is fast, flexible, and doesn't dilute their ownership.

Latest news Capchase

-

This Week in B2B: Realizing Operational Certainty Through Payments Innovation

The B2B landscape is full of what buyers and suppliers don’t know. In today’s rapidly evolving landscape, B2B businesses across the transaction frequently

9 months, 3 weeks ago

-

4 Things B2B CPOs Should Know About Shrinking Paper Payments

The business-to-business (B2B) landscape is undergoing an explosion of innovation — especially around payments. Wednesday (Sept. 18) alone, news broke

9 months, 3 weeks ago

-

Capchase and Stripe Partner on B2B BNPL in US

Capchase and Stripe have partnered to offer a B2B buy now, pay later (BNPL) payment method in the United States. With this partnership, Capchase’s B2B

9 months, 3 weeks ago