Trovata

Automated Cash Management & Forecasting, powered by Open Banking.

Overview Trovata ?

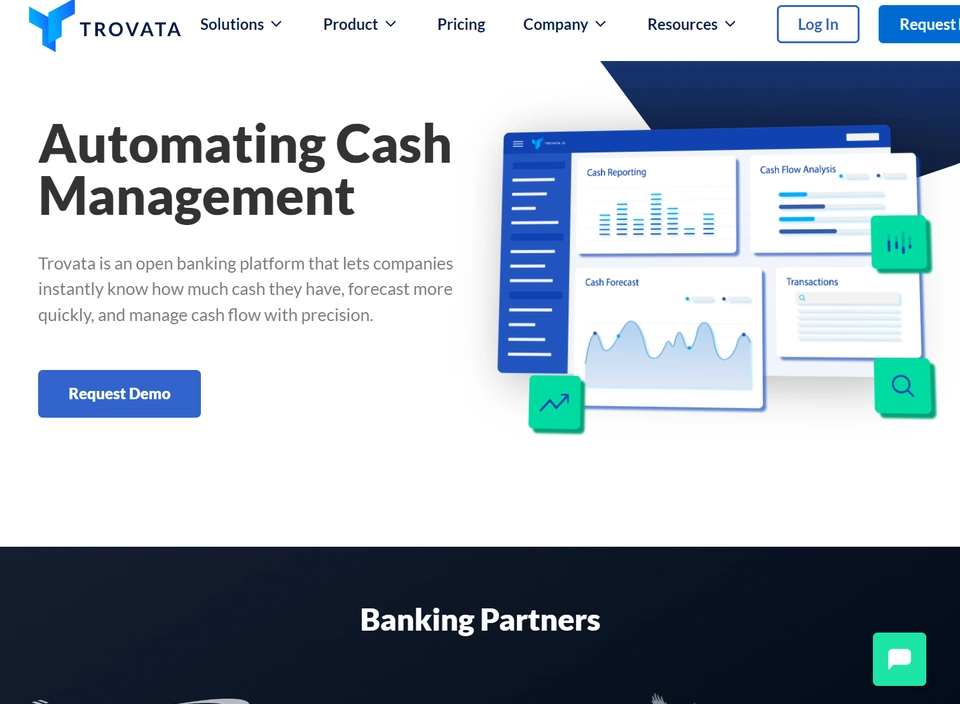

Trovata provides a platform for businesses to automate cash reporting, forecasting, analysis, and money movement. Companies can gain insights into their cash flows and make business decisions easier. The experience is fully integrated with corporate banking APIs for multi-bank data aggregation, cash visibility, analysis, forecasting, and payments with no IT required.