James

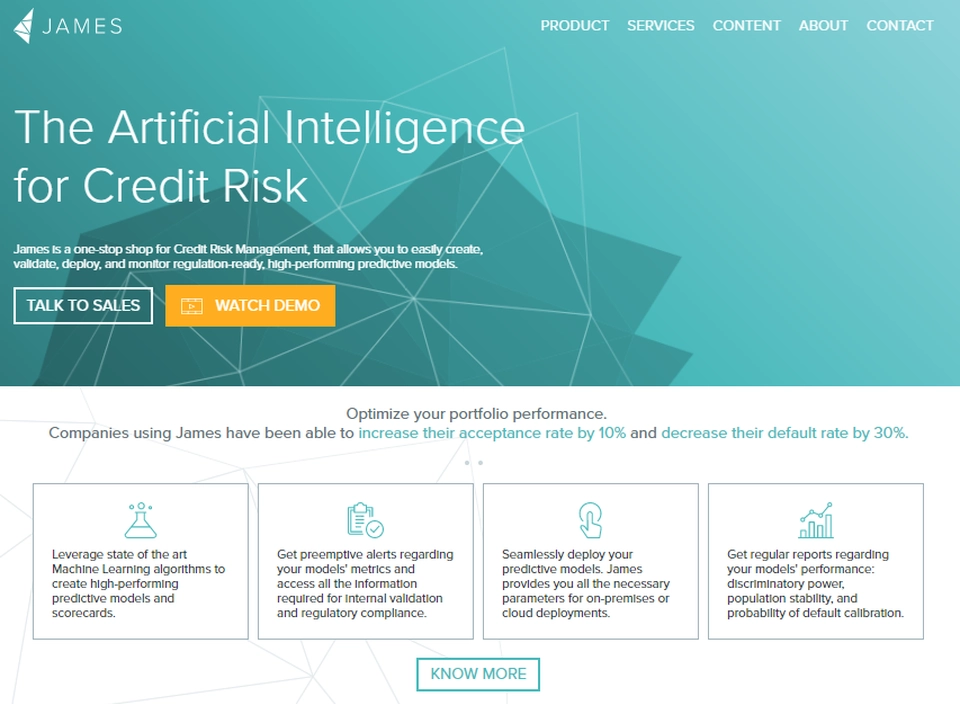

The AI for Credit Risk

Overview James ?

James is a data science company, in the credit risk space. We started in 2013, and have been working on helping banks fight credit defaults using machine learning. The company’s flagship product is called James, and is a narrow AI for risk departments. It allows risk officers to build, test and validate credit scoring models

Latest news James

-

LGBT Great Reveals Financial Firms Must Strive For Greater Inclusion or Risk Losing Valuable Talent

Gen Z has quickly established itself as the most diverse generation to enter the workforce, however, a new report from LGBT Great, a global diversity …

7 months ago

-

‘Election is Over’: Ripple Cofounder’s $10M Donation to Harris Raises Eyebrows

The post ‘Election is Over’: Ripple Cofounder’s $10M Donation to Harris Raises Eyebrows appeared first on Coinpedia Fintech News The cryptocurrency community is buzzing after …

8 months, 2 weeks ago

-

Capital One delivers earnings beat as merger scrutiny intensifies

The credit card heavyweight outpaced analysts' profitability expectations in the third quarter, but its pending acquisition of Discover Financial Services faces a new potential obstacle.

8 months, 2 weeks ago