Intuit

Small Business, Personal Finance and Tax Software

Overview Intuit ?

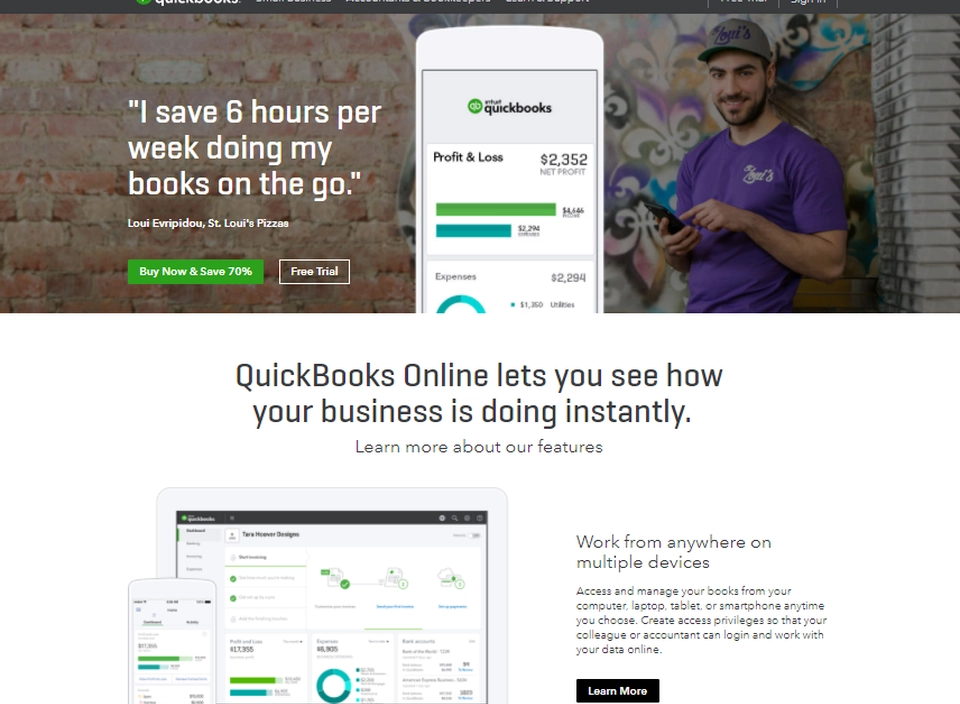

Intuit offers business and financial management solutions for SMBs, financial institutions, consumers and accounting professionals. The company’s product portfolio includes TurboTax, a software solution that offers free tax filing, efile taxes, and income tax returns; Quicken; QuickBooks; Mint.com, and more. The company also offers end-to-end solutions for online tax preparation, download products, mobile tax prep, mortgage interest and property tax, corporations tax, military tax, and more

Latest news Intuit

-

Adyen and Intuit Team to Speed Payments for UK Small Businesses

QuickBooks maker Intuit has launched a collaboration with Dutch payments firm Adyen. The partnership is designed to help small and medium-sized businesses

7 months, 2 weeks ago

-

Pipe CEO Says Business Card Product Shifts Small Business Capital From Banks to Software Platforms

Banks used to be the only game in town for small businesses looking to set up an account, get credit and hear advice about managing …

8 months, 2 weeks ago

-

Two technology-oriented credit unions plan to merge

Digital Federal Credit Union and First Tech Federal Credit Union, among the largest in the country, originated from technology companies.

9 months, 2 weeks ago