Ebury

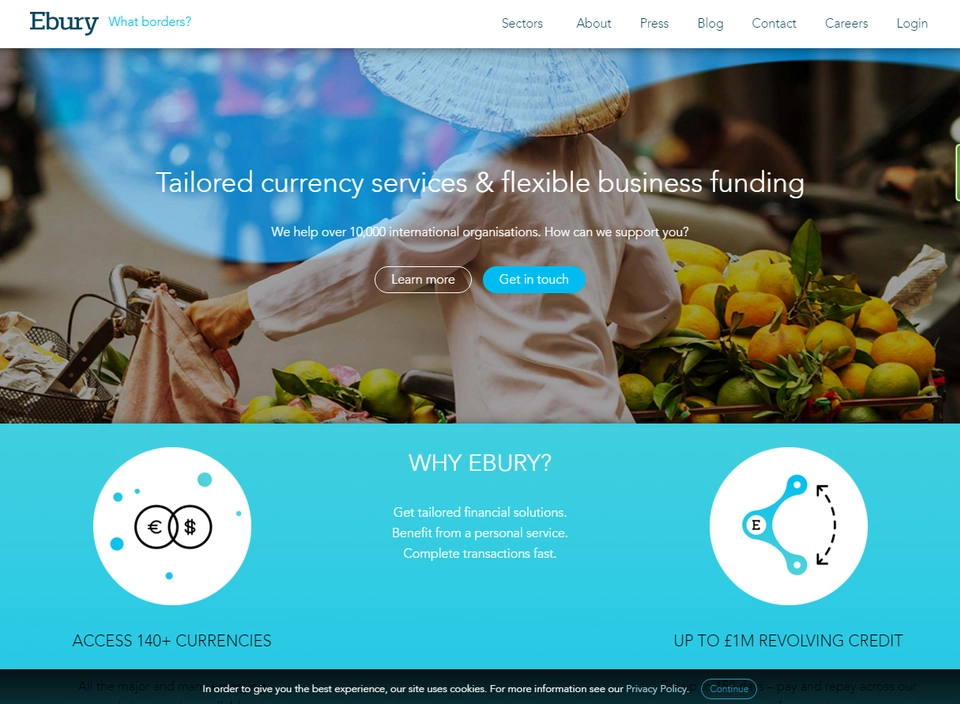

Providing Business Lending & Currency Services

Overview Ebury ?

Ebury is a financial services company specifically designed to empower small and medium-sized businesses that want to trade internationally

Latest news Ebury

-

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury, a global financial technology firm, has announced a partnership with the Southampton Football Club for the 2024-2025 season.

8 months, 3 weeks ago

-

Finovate Global New Zealand: Business Banking, Wealthtech, and Cross-Border Payments

This week’s edition of Finovate Global showcases news from the fintech industry in New Zealand. Business banking account Emerge secures investment In a round led …

9 months ago

-

Exclusive: Ebury Starts Offering Payments Services to FX and CFDs Brokers

Ebury, a Santander-owned payments company, has expanded its scope of clientele and has been onboarding forex and contracts for differences (CFDs) brokers, Finance Magnates learned …

9 months, 2 weeks ago