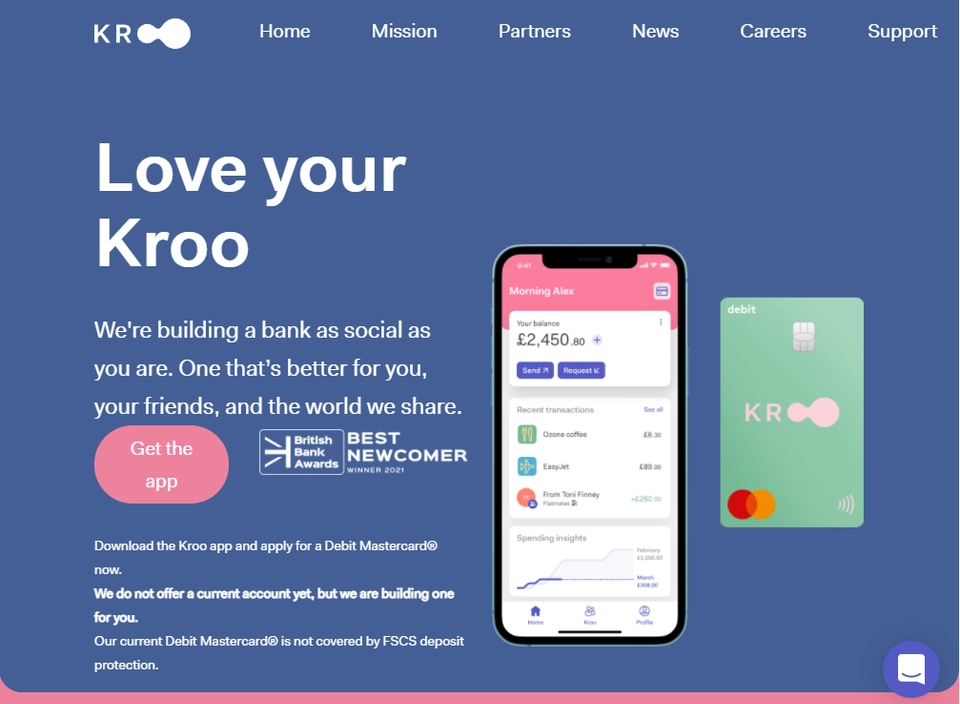

Kroo

Where friends & money meet.

Overview Kroo ?

Kroo is building a powerful new UK bank to allow its customers to easily participate in shared financial activity with each other and champion social causes that impact their world. Kroo has been built on a state-of-the-art agile technology platform that provides a safe, secure and intuitively designed current account, from which a customer can navigate their financial lives.