Teller

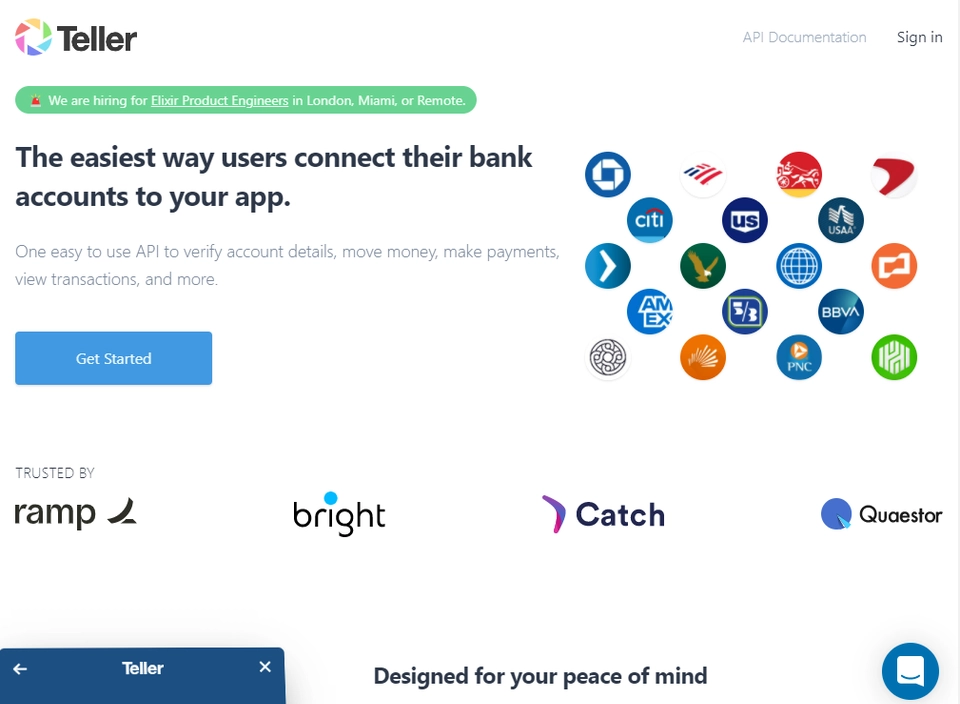

The easiest way users connect their bank accounts to your app.

Overview Teller ?

Teller is the API for bank accounts. Its API enables developers to build applications that connect with their users’ bank accounts in a manner that is many more times reliable, predictable, performant, and fair than anything else available.