Nymbus

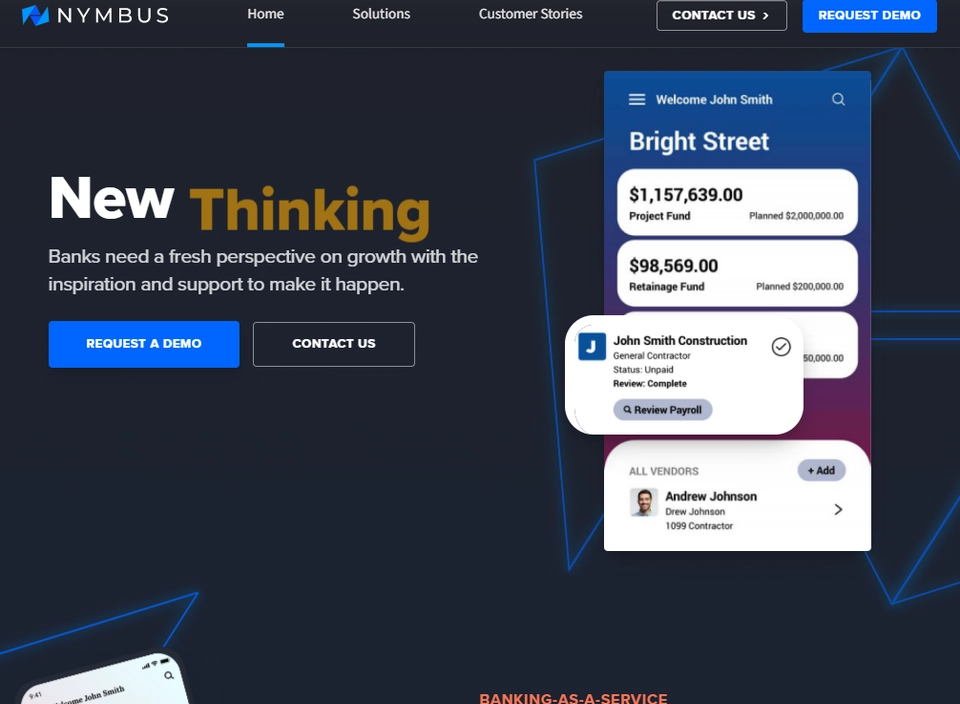

NYMBUS enables financial institutions to digitally transform their businesses with their core platform

Overview Nymbus ?

Nymbus enables banks and credit unions of any size to grow and attract new market segments by delivering a full suite of banking technology, including Loan Origination, CRM and Digital, along with the operational resources to launch and run a new digital bank. The company recently launched Nymbus Labs, built and operated to systematically remove barriers for institutions to leverage niche digital banks that connect to the communities they serve, create new revenue streams, and innovate.