Zilch

Creating the best way to pay over time. Anywhere. Zero interest. Zero surprises. Zero stress.

Overview Zilch ?

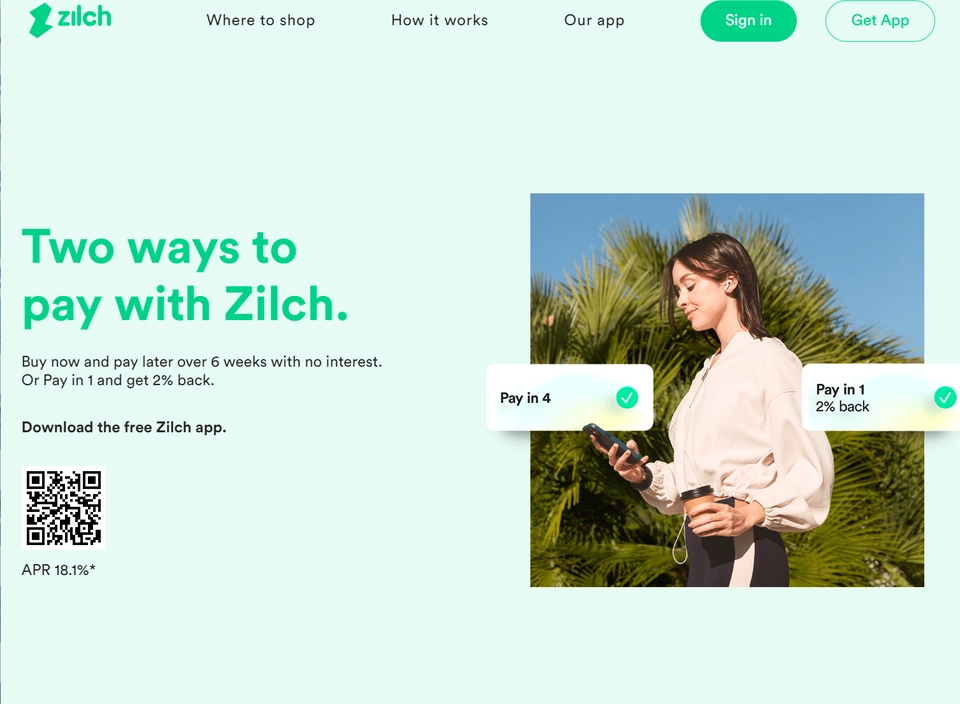

Zilch is an over-the-top (OTT) Buy Now Pay Later (BNPL) product that allows its customers to shop wherever Mastercard is accepted and spread their payment over 6 weeks for zero interest and zero fees whenever they chose to buy from one of Zilch’s 5,000+ retail affiliate partners. Unlike traditional BNPL products that require technical integration with merchants, Zilch’s model does not require any integration and can thus instantly provide its users’ accessibility everywhere.

Le ultime news di Zilch

-

Apple says support for redeeming rewards coming to Apple Pay

On Thursday, Apple celebrated 10 years with Apple Pay and announced how the service will evolve in the future, including the future addition of redeeming

8 mesi, 4 settimane fa

-

Apple says support for redeeming rewards with more partners is coming to Apple Pay

On Thursday, Apple celebrated 10 years with Apple Pay and announced how the service will evolve in the future, including features like redeeming rewards

8 mesi, 4 settimane fa

-

British FinTechs Tell Government That Regulations Are Stifling Growth

A group of U.K. FinTechs has reportedly met with the country’s government with concerns about growth limits. At that meeting, Bloomberg News reported

9 mesi fa