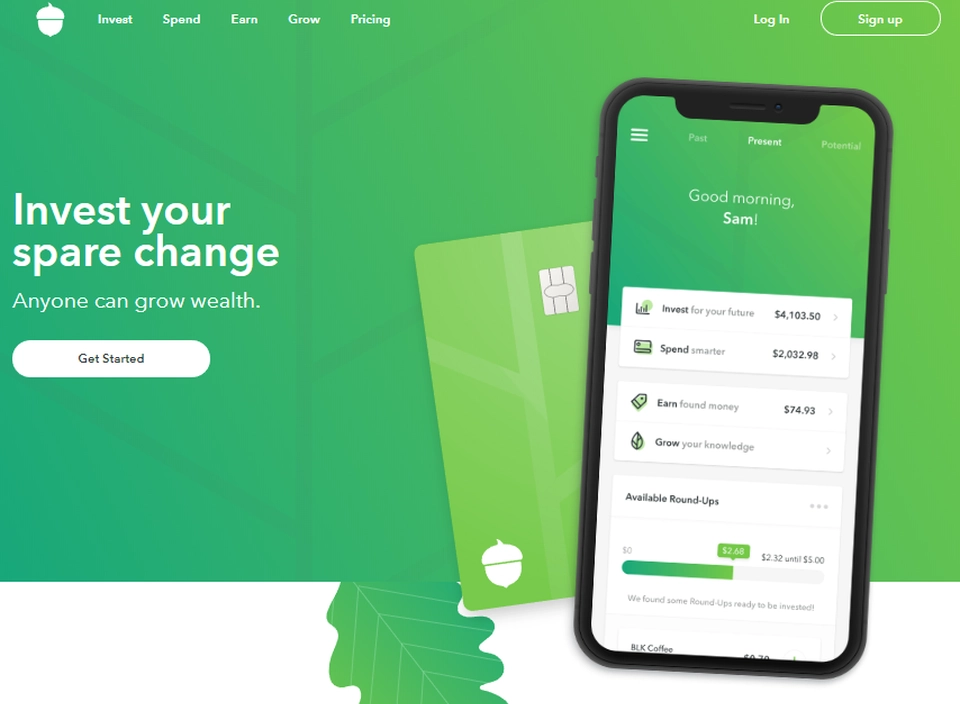

Acorns

Invest spare change automatically from everyday purchases into a diversified portfolio.

Overview Acorns ?

Acorns helps you proactively invest. They round up each of your transactions to the nearest dollar, and invest the change into a diversified portfolio. Simply connect a credit card, or debit card and a checking account, and tell them about yourself. Their mission is to look after the financial best interests of the up-and-coming, beginning with the empowering step of micro-investing. By ‘upand-coming,’ they mean anyone working hard today, striving for a better future.

Le ultime news di Acorns

-

Google Wallet and Acorns Launch Payment Solution Designed for Kids

Parents can now provide their 7- to 12-year-old kids with a wearable payment device powered by Google Wallet and GoHenry by Acorns.

11 mesi fa

-

Google integrates GoHenry into smartwatch for kids

Today, GoHenry by Acorns, a debit card and financial education app designed for 6-18 year olds, has announced a collaboration with Google Wallet to integrate …

11 mesi fa

-

Two banks explain why they are going the BaaS 'middleware' route

Lincoln Savings Bank and Vantage Bank are two new clients of banking-as-a-service provider Unit. They say it improves their ability to 'go direct' rather than …

11 mesi, 1 settimana fa