Aave

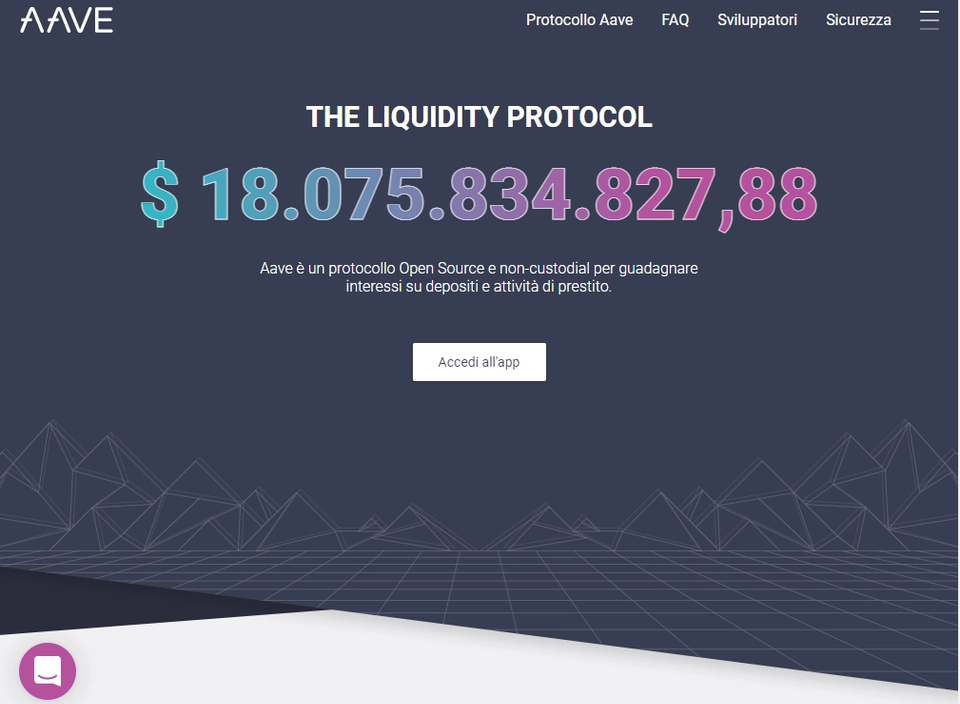

An open source and non-custodial liquidity protocol.

Overview Aave ?

Aave is a decentralized non-custodial liquidity protocol where users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) fashion.

Le ultime news di Aave

-

$200 in Qubetics Could Grow to $106K – The Best Crypto to Join Now Is Here as Chainlink Eyes $30 and Aave Attracts Whales

Cryptocurrencies are revolutionising the way we think about finance, and the pace of innovation is simply mind-blowing. From new presales to game-changing developments, there’s always …

7 mesi fa

-

DeFi Carry Trade Takes Root and Dino Coins Reemerge: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)It was only a matter of time before the bitcoin bull market reignited excitement in the DeFi …

7 mesi fa

-

Crypto Daybook Americas: DeFi Carry Trade Takes Root and Dino Coins Reemerge

By Omkar Godbole (All times ET unless indicated otherwise)It was only a matter of time before the bitcoin bull market reignited excitement in the DeFi …

7 mesi fa