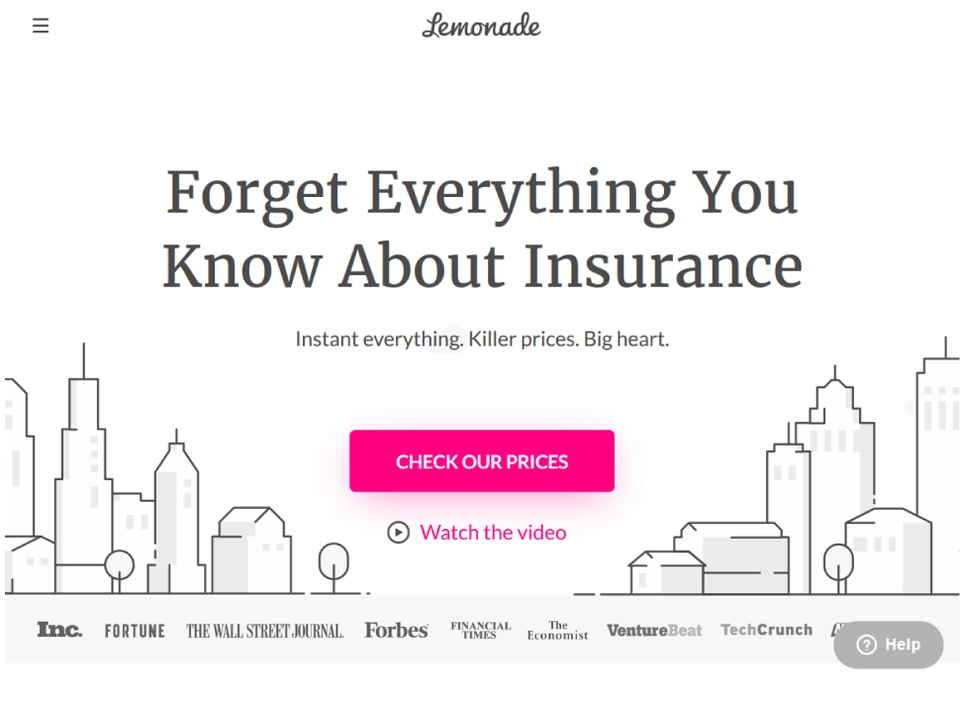

Lemonade

The world’s first Peer to Peer insurance carrier

Overview Lemonade ?

Lemonade is Peer to Peer insurance. Insurance has remained fundamentally unchanged for centuries, so an insurance product for today's consumer required re-architecting every part of the value chain. The result is Lemonade, a technology-first and legacy-free insurance carrier, offering a product that is instantaneous, un-conflicted and downright delightful.

Le ultime news di Lemonade

-

November Is No Turkey as FinTech IPO Roars Ahead 25% for the Month

The end of November is here — due to the holiday-shortened trading week — and for the FinTech IPO Index, the month was stellar. The …

7 mesi fa

-

Europe’s most valuable fintech, and which startups became unicorns this year

Welcome to TechCrunch Fintech! This week, we’re looking at Revolut’s reported valuation hike, fintech unicorns, the Disrupt Fintech Stage, and more. To

10 mesi, 4 settimane fa

-

FinTech IPO Index Loses 5% as NerdWallet and Lemonade Slip on Earnings

Earnings season’s in full swing and proved to be less than kind to the FinTech IPO Index, which gave up 5%. Double digit declines on …

11 mesi fa