Stock Market Rally: This Dangerous Indicator Just Flashed a Warning Signal

The stock market's "fear index" remains elevated despite a massive relief rally since March. | Image: Nicole Pereira/NYSE via AP

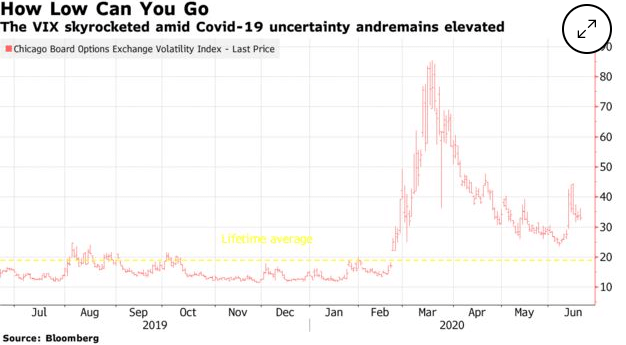

- The VIX has never been this high after such a strong rally.

- The fear gauge might not return to a normal level until there is a vaccine.

- A high VIX is bearish for the stock market.

The CBOE Volatility Index (VIX) measures the level of risk or fear in the stock market. It’s often referred to as the fear gauge or fear index.

An elevated VIX means that investors’ fear is high. The fear gauge tends to move inversely to the stock market. When stock prices go up, the VIX should go down.

The Fear Gauge Shouldn’t Be That High

After a strong S&P 500 rally, the VIX has remained high in historical terms. The VIX has more than halved since mid-March peak of just below 83 to close around 28 on Thursday.

A VIX level above 20 is high . By recent measures, a normal VIX reading would be between 12 and 20. Such a high VIX level despite such a strong rally is worrying. It might signal a market correction.

According to Cantor Fitzgerald LP, U.S. stock market volatility is unlikely to return to normal levels until there is a vaccine against the virus.

Strategist Eric Johnston said in a note that the VIX is still almost ten points above its lifetime average of 19 and may not be backing down much anytime soon:

Given continued uncertainties as the economy reopens, an upcoming election, along with the daily bid for volatility ahead of case data on select U.S. states, we don’t foresee a VIX below 20 until an approved vaccine for Covid is achieved.

The Stock Market Is Facing Many Risks

An elevated VIX is a bearish signal. The stock market currently has many downside risks after rallying significantly from the March lows. The S&P 500 is currently trading about 20 times earnings estimates for 2021, which is a historic high.

Plus, virus cases are on the rise again, despite the reopening of many states and the creation of new jobs.

As cases are increasing, states have taken steps to try to control the spread of the virus. Investors may protect themselves against the prospect of tightening restrictions to slow the spread of the virus, which could hamper economic recovery.

In recent days, there have been several bearish bets suggesting that the S&P 500 may fall by around 7% before the end of the quarter .

Some investors are betting that by mid-September the VIX could more than double in value and return to the highs seen in March when fears of the pandemic gripped world markets.

The S&P 500 rose 20% in the second quarter. A decline, along with some volatility, is natural and could be healthy for the long-term viability of the recovery.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com.