In the face of economic uncertainty, banks and credit unions face immense pressure to reduce costs and streamline operations. Marketing budgets are often among the first cut. However, this can be short-sighted and can harm an institution’s long-term growth.

Here’s how to hold onto your marketing budget this year and how to build a strong case that justifies your initiatives and proves their worth.

With regular reporting and communication, you can turn the perception of your marketing budget into an investment to be optimized, rather than an expense to be minimized.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Banking Industry Challenges Tighten Budget Vise

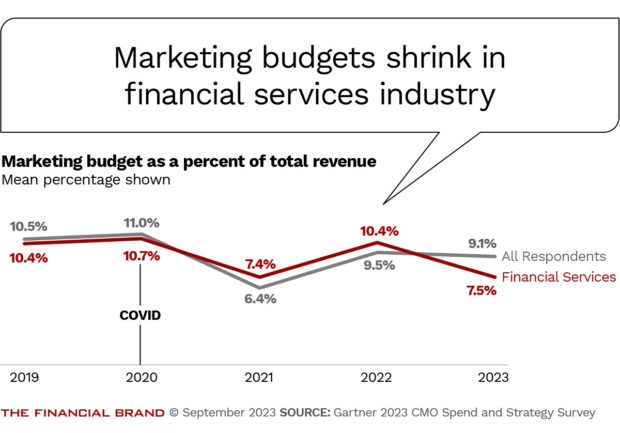

Since the pandemic, bank marketing budgets have remained stagnant or declined, even as banks have grown and evolved. In 2024, banks are continuing to face compressed net interest margins and funding challenges as interest rates remain high, putting pressure on minimizing expenses until interest rates begin to moderate — increasingly less likely at least in 2024.

Additionally, money has exited the banking system in search of higher rates from treasury securities and money market funds, making it even more expensive and competitive for institutions to attract new accounts. Customer acquisition costs have increased, and deposit costs remain historically high due to the rate environment.

These critical factors set up the importance of collecting and presenting data that can support and justify your marketing investments.

Marketing is essential for financial institution growth. That’s especially so in a challenging economy, where competition among financial institutions has increased, a strong marketing plan is essential for attracting new customers, retaining existing customers, and building brand awareness.

By cutting your marketing budget, you’re giving up on growth.

Marketing and sales initiatives remain essential for banks and credit unions to generate awareness of their brands, their value proposition, and their products and services. Marketing also enables the building of deeper relationships with account holders.

Read more: Move Over CMOs, Data-Driven Growth Marketers Are Taking Over

The Proactive Marketer: Don’t Wait to Justify Your Budget

A common mistake financial marketers make is waiting until they’re into the year-end budget review process to highlight their proposed initiatives or to demonstrate the institution’s return on marketing investment.

Defending your marketing should be seen as a year-round task.

By constantly communicating the results of marketing investments and Marketing’s value, marketers can take back ownership of the narrative around their tactics, and set the scene for a more successful budget discussion.

1. Understand some key factors in the budget process:

- Who are the budget decision makers in your organization?

- What factors go into the budget setting process?

- How do the organization’s strategic and financial objectives impact the budget composition and its focus areas?

- Who is responsible for the ultimate review?

2. Be ready to show the data. The best way to build the case for holding onto your marketing budget is to prove the value. This includes showing how marketing has contributed to growth in the past and how it can continue to contribute to growth in the future.

Use specific metrics that speak the language of business results, like loan growth, deposit growth, profitability and revenue. This builds credibility and gives marketing a seat at the table when determining the strategic priorities for the institution to invest in each year.

3. Recognize that knowing the data is just as important as showing it. Be prepared to answer questions about the data, what it means, and how it is collected.

This doesn’t mean memorizing each cell of an analysis, nor faking it. For example, never highlight metrics you can’t explain the calculations of, like CPM (cost per thousand) or engagement rate. Don’t brag about a conversion rate where the converting action is unclear.

Check Your Ego at the Boardroom Door:

Treat questions as an opportunity to demonstrate your understanding of the results, rather than as parts of an interrogation.

Each time you invest in an event, campaign or promotion, comprehensive pre- and post- event results should be tabulated and shared. This keeps the process focused on continuous improvement and optimization and demonstrates that your focus is on results, not just activities.

Choosing Data That Speaks Management Language

4. Be specific about results. When presenting your case, be detailed about your marketing plans for the year and what the projected results will be. The numbers you forecast must be tied directly back to management’s objectives.

By meeting early and often with stakeholders who are setting and implementing the organization’s strategic objectives, you can quickly take direction to craft marketing tactics and reporting that focus on the institution’s priorities. This will illuminate exactly how your marketing budget contributes to accomplishing the institution’s strategic and financial goals.

Use the Metrics Management Believes In

Read more:

- Pay for Performance: The Tactic Saving Marketing Budgets in 2024

- How CMOs Can Maximize Their Marketing Budgets & Prevent Cuts

- Why Banks Shouldn’t Slash Their Marketing Budgets

Imperative to being able to be specific about the results is a process of regular performance optimization.

Remember, you aren’t asking for a bucket of money, but for an investment that comes with responsibility and accountability — good stewardship.

Teams responsible for marketing initiatives should meet frequently (weekly or biweekly) to review performance and identify optimization opportunities to meet your business goals.

5. Get buy-in from stakeholders. Before you present your budget for approval each year, get regular buy-in from other stakeholders.

Making this extra effort helps eliminate questions or confusion around measurement and results down the line when your budget is being evaluated.

Ditch Marketing Jargon When Talking to Bankers:

Many stakeholders have not heard common marketing terms and don't understand the tactics and their power like marketers do. Speak plain English.

Focus on meeting people where they are — and speaking to their concerns by focusing on their business and strategic priorities and objectives, using their language and metrics, not yours.

6. Consider scheduling regular or quarterly meetings with your internal clients — your finance team and the lines of business.

Understand internal clients’ priorities and needs so you can begin to predict their marketing and sales support needs. It also allows you to agree on common definitions for the results you will be held to.

Don’t let a misaligned definition change the narrative around the success of marketing campaigns.

Read more: Attention to Branch Basics Can Stem Account Attrition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Defending Your Budget When Stakeholders Make Common Attacks

No matter how strong a case you make and how often you make it, you will have to overcome objections and criticisms.

Understand that many harbor the misconception that marketing results are “superficial” and contribute only towards brand awareness or advertising goals. By keeping your marketing tactics and results narrowly focused on the institution’s strategy and tying your goals and metrics back to the strategy, you can prove that the marketing function should be present when the strategies are being set — and that your activities and budget are essential to implementing the strategies and achieving the results.

How do you parry the thrusts of those who would attack your budget? Here are five sample objections and suggested responses:

Objection 1: “We need to cut expenses this year, so the marketing budget is being reduced.”

Answer: “Most components of the marketing budget are directly tied to generating loans, deposits and new customers, so I hope the budget reflects corresponding reductions in those revenue items.”

Objection 2: “We are not convinced that we are generating any business from our marketing efforts.”

Answer: “The reporting I’ve developed with Finance’s help shows that when our organization advertises, we bring in new [deposits/loans/customers] at a very acceptable cost.”

Objection 3: “We are just going to purchase wholesale funds because it’s cheaper than running a deposit campaign.”

Answer: “Finance has found that marketing can bring in deposits at or below the cost of wholesale funds, and we get new customers who our bankers can grow into long-term relationships.”

Objection 4: “We don’t need marketing support to generate leads.”

Answer: “This is true, but new leads, and using data, improve the targeting, therefore increasing the quality of leads and improving conversion rates.”

Objection 5: “Marketing doesn’t drive new customers, so why should we pay for it?”

Answer: Let the numbers do the talking. Arm them with the data to demonstrate that brand awareness and new household growth do rise during marketing campaigns.

Read more: Influencer Marketing: Is the ROI Worth it for Community Banks?

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

A Final Initiative: Prove Marketing’s Worth with Every Project

As you manage and plan marketing initiatives, campaigns and projects throughout the year, treat every one as if it is happening during your budget process. By implementing a regular process for continuously proving the worth of every marketing initiative, you will no longer spend the last days of the fourth quarter scrambling to measure the value of each initiative.

Work with your finance and leadership team early and often to align your marketing programs with the institution’s strategic objectives and get internal buy-in on how you will measure success before the programs launch.

This process takes time and education. But with regular reporting and communication, your marketing budget will be viewed as an investment in growth, rather than the first target for cost-cutting.

About the Author

Ally Akins is a consultant with Capital Performance Group, LLC, a consulting firm that specializes in strategy, marketing, distribution planning and risk management for financial services companies.