One

Credit that automatically grows with you.

Overview One ?

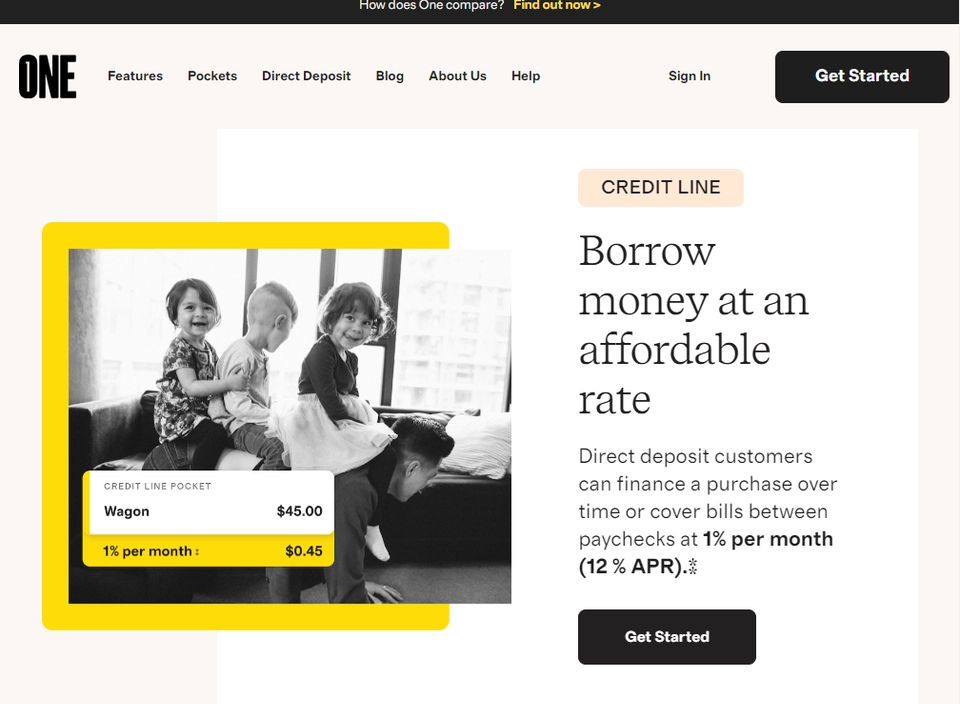

One is a fintech company which provides families and individuals with an account combining saving, spending, sharing, budgeting, and borrowing. Since making its product generally available in September of 2020, the company has enhanced its core product offering, launching overdraft protection, an Auto-Save feature that rewards automatic savings contributions at 3.00% APY, cash flow-based Credit Lines that enables borrowing as low as 12% APR, and a Credit Builder product.